Long-Term Outlook: Inflation Hedge and Sustainability Dividends

Utility prices have historically trended upward due to infrastructure needs and fuel costs. Subscriptions often peg your energy at a discount, creating a hedge that grows more valuable as rates climb. Over time, predictability compounds into strategic, stress-reducing financial stability.

Long-Term Outlook: Inflation Hedge and Sustainability Dividends

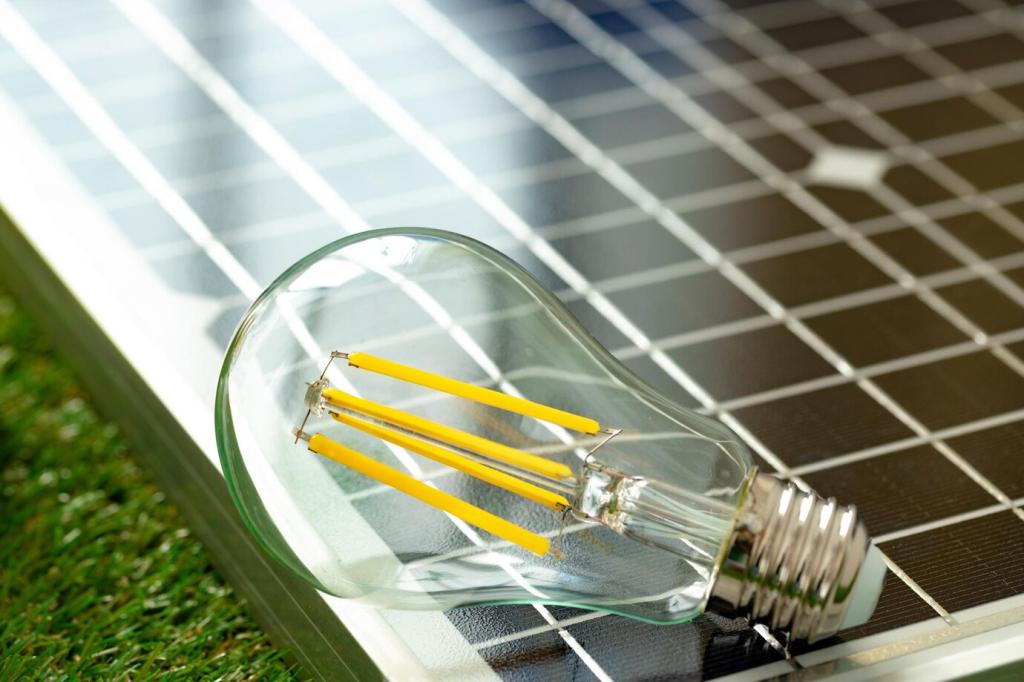

Households and businesses increasingly value clean energy alignment. While subscriptions focus on savings, they also cut emissions linked to your consumption. Share your story on social media, and invite followers to join; collective participation can nudge utilities toward fairer, more transparent pricing.